After several years of consistent decline, Star Ratings 2026 remained largely consistent from last year. The overall average Star Rating was 3.66 compared to 2025’s average Star Rating of 3.65. 18 MAPD contracts earned 5 Stars (3.5%), up from 9 last year and ~ 64% of MAPD enrollees are in health plans rated 4 Stars or higher. This is indicative of the Tukey Outlier Deletion method working as intended – removing extreme data points, both high and low, that could distort performance benchmarks, ensuring fairer and more stable cut points for Star Ratings.

Why Choose Icario for Star Ratings Improvement?

Icario leverages data from millions of member touchpoints, advanced behavioral insights, and our proprietary engagement platform to drive meaningful improvements in Star Ratings. Our personalized, data-driven approach ensures high engagement rates, closes care gaps, and enhances member satisfaction. As a result, health plans partnering with Icario experience a tremendous boost in performance and improved member satisfaction rates.

300%

increase in high-value healthcare activities

75%

of members said an Icario program improved their satisfaction with the plan

6x ROI

from Quality Bonus Payments (QBP)

Comprehensive Data Utilization

Icario leverages extensive member data to provide actionable insights that improve Star Ratings. By identifying key areas for improvement and tailoring interventions to specific member needs, we help enhance a health plan’s performance across every measured category.

Predictive Insights for Quality Improvement

Predictive behavioral science tools enable us to forecast member behaviors and design interventions that address potential gaps in care before they occur. This proactive approach ensures that plans will not only meet but exceed Star Ratings criteria.

Integrated Engagement Strategies

Our proprietary engagement platform integrates real-time analytics with personalized communication strategies to optimize member outreach. By focusing on whole person data, we create effective engagement plans that drive better health outcomes and improve Star Ratings.

Medicare Star Ratings 2026

Overall Performance and Trends

There were no major surprises in this year’s Star Ratings performance, especially with the large national payers conducting announcements on their performance ahead of the official Star Ratings 2026 release.

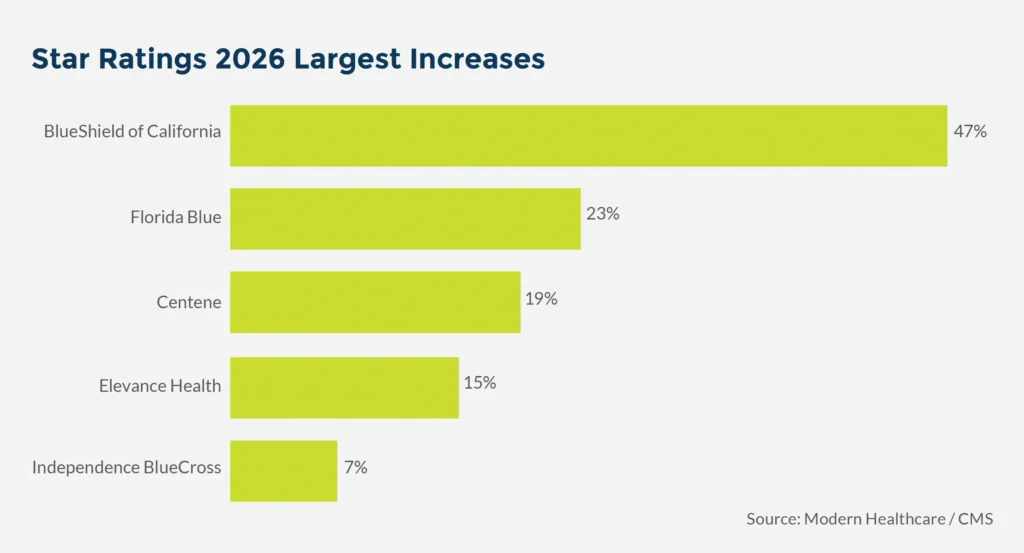

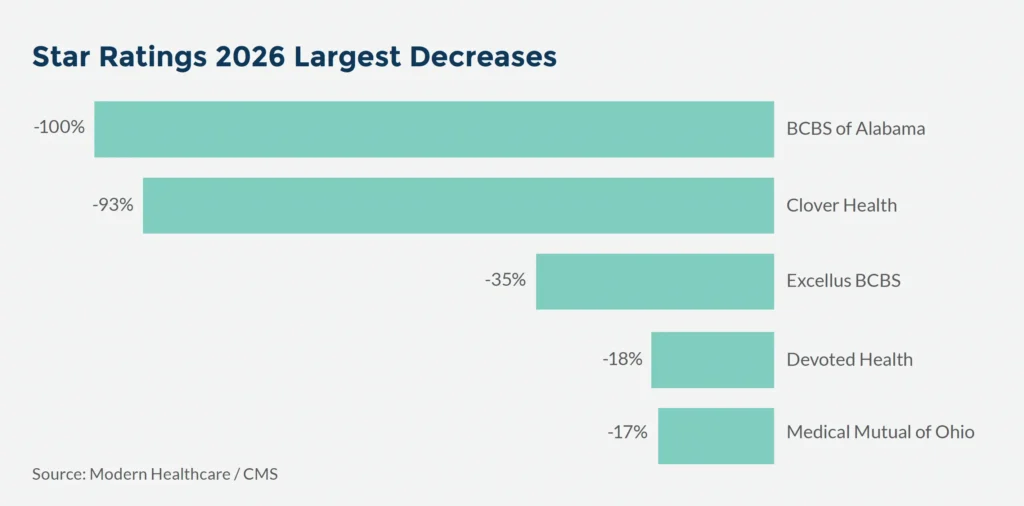

Here are the major health plan increases and decreases compared to last year:

Star Ratings cut points for 4+ Star performance have become tougher with ~60% of all 4 Star cut points higher than 2025. With Tukey, most of the outliers were on the low end, so removing them generally raises cut points and Star Ratings 2026 performance demonstrates this impact.

Maintaining or improving a 4+ Star performance is harder than ever and health plans cannot rely only on incremental improvements. The financial stakes remain high, so health plans should treat Star Ratings not just as quality reporting or compliance, but as a core business lever for profitability and market position.

SNP Care Management National Performance

Single Measure National Competitor Performance Comparison

Member Experience Weighting Change

Star Ratings 2026 brought the reduction of the member experience measures (CAHPS and Admin) from 4x weight to 2x. Health plans that performed worse on CAHPS found that this weighting change gave them a tailwind, and headwind for those that typically perform better on CAHPS. Centene saw significant improvement in their percentage of members in 4+ Star contracts compared to Star Ratings 2025, and the member experience weighting shift influenced that impact. See the National Competitor Performance on CAHPS table below.

CAHPS National Competitor Performance Comparison

Key Industry Insights and Trends from Star Ratings 2026

- Star Ratings pressure intensifies: With tougher cut points and higher performance thresholds, many plans are seeing flat or declining Star Ratings despite continued quality improvement efforts.

- Star Ratings performance is financially significant: Even amid volatility, a single-star difference on one measure can mean hundreds of millions in bonus payments and stronger competitive positioning and sustainability. (Ex: Elevance TTY/FL – one failed call dropped them to 4 Stars for the measure, but equated to $190M)

- Scale creates advantage: Large, established carriers like UnitedHealthcare and CVS/Aetna are better positioned to sustain high-rating performance than smaller or regional plans.

- Strategic market pullbacks: Major payers including UnitedHealth, Humana, and CVS are scaling back county participation in calendar year 2026, trimming less profitable or underperforming markets. There have also been full product pullouts like UCare with their MAPD product (180,000 members). Continue to see these trend.

- CMS Lawsuits: It is likely that we will see a third consecutive year of payers suing CMS over is Star Ratings, particularly focused on Tukey and guardrails, methodology and Call Center TTY/FL measures.

- Loss of Reward Factor and the EHO4All Reward: The EHO4all is a significant headwind for the industry, particularly at the 4.5 and 5 Star health plans. Almost all 5Star health plans (15 of the 18) achieved 5Stars with 0.4 Reward Factor. Most 4.5Star health plants (71 of the 73) achieved that with Reward Factor, and there was also a good amount of 4Star health plans that achieved that performance due to Reward Factor. As of calendar year 2025 (Star Ratings 2027) Reward Factor has been “replaced” by the Health Equity Index (HEI), soon to be known as Excellent Health Outcomes for All (EHO4all).

This is not an “apples-to-apples” replacement since not all contracts receiving Reward Factor are eligible for HEI reward (certain % of DE/LIS/Disabled members needed), and for those eligible it is a lot harder to achieve the full HEI reward. This is an extremely important factor for strategy moving forward for health plans relying on Reward Factor currently. Their overall performance and rating are contingent on Reward Factor – but this is not true performance. These health plans will need to find ways to “make up” the difference.

However, the HEI rewards themselves are likely to be lower with ~50% of health plans receiving no reward who currently receive Reward Factor, and the other half earning a rewards of ~0.10. The biggest impact will primarily be at the 4.5 and 5 Star level. Industry experts estimate ~17% decline in the number of 4.5 and 5 Star health plans as a result. We will see this impact and disruption when the Star Ratings 2027 are released next October.

Summary

Star Ratings 2026 revealed continued pressure on high-performing MAPD health plans, with nearly a third of 4Star contracts from 2025 falling below 4 Stars due to rising cut points and the impact of member experience weighting. With Reward Factor sunset as of calendar year 2025 and EHO4all in place, health plans need strategic partners who can deliver measurable impact on quality, member experience, and operational efficiencies. Vendors who can deliver on this, understand the regulatory landscape, and take proactive steps for risk mitigation are well-positioned to support health plans navigating this volatile and unprecedented time in the healthcare industry.

Written by: Muratore Advisory Services